educational foundations

Educational Foundations Serving Our Community

There are four non-profit 501(c)(3) foundations that have been established to support LASD and BCS education in our community. These are:

Los Altos Educational Foundation (LAEF) - EIN: 94-2862793

Bullis-Purissima Elementary School Foundation (BCS Foundation) - EIN: 48-1298690

Bullis-Purissima Elementary School (BCS School) - EIN: 48-1298689

Bullis Booster Club - EIN: 46-3439920

The information discussed here came primarily from web sites and from IRS Form 990s filed by each of the organizations.

Los Altos Educational Foundation (LAEF)

LAEF website

A non-profit organization led by parent volunteers, LAEF raises funds from parents and the community to provide teachers and staff for essential programs at all nine LASD neighborhood schools. The Foundation was formed in 1982 by a group of parents in search of a way to support LASD in a time of financial crisis. Budget cuts and restrictive state legislation (Proposition 13) had created serious financial challenges for the district.

LAEF has many volunteers and one or more paid staff (expenses are approximately 8% of contributions).

LAEF strives for 100% participation from all families with a suggested donation is $1,200 per child.

The 2017-18 annual report indicates that approximately 1,770 families (~42% participation) contributed $2,596,700 (average of ~$1470 per family contributing). The average contribution from the approximately 200 alumni families and community member/groups was ~$1,580.

Since many families choose not to participate, the average contribution per LASD student was ~$850.

Approximately 90% of contributions to the LEAF Foundation are directly contributed to LASD and approximately 8% of the contributions are expenses for fundraising, staff, organizing, etc. The residual, if less than the total contributions, will go into the fund balance (a reserve), and if the contributions to LASD and expenses are greater than contributions, then the fund balance (the reserve) is reduced.

LASD counts on next year’s LAEF donation, since LASD has to make advance commitments to teachers, staff, aides and counselors delivering art, music, library, computer science, STEM, PE and a variety of services to the students. LAEF takes the donation commitment to LASD seriously and tries to end the year with an adequate fund balance to meet next year’s commitment. Maintaining a balance between these two metrics is an important goal.

Bullis-Purissima Elementary School Foundation (BCS Foundation)

BCS Foundation website

A non-profit organization led by parent volunteers, the BCS Foundations raises funds from parents and the community to protect small class sizes, attract innovative educational professionals, and secure specialists in science, technology, engineering, art, math, Mandarin, Spanish, drama, music and PE.

The BCS Foundation filed an initial Form 990 in 2003, receiving donations of $174K, $1.1M and $6.0M, in its first three years (2003, 2004 and 2005). In the same year, the initial 2003 Charter Request was filed with the clear goal of either buying the Purimmisa-Bullis site or reopening it as a charter school. The narrative in the 2003 filing helps indicate why the BCS Foundation raised these funds. Although filings by the BCS Foundation, and several other foundations, point to the source of ~$2M of the $6M donated in 2005, the source of the remaining $4M is not transparent.

The BCS Foundation has many volunteers and no paid staff (expenses are approximately 3% of contributions). The board is comprised of parent volunteers who serve as ambassadors for the school while raising funds through the Annual Campaign.

The foundation strives for 100% participation.

Information on the actual participation of families, alumni families and community members, and the average contribution per family, alumni or community members does not seem to be readily available. BCS Foundation Board has chosen not to be transparent in this regard.

The suggested contribution is $5,000 per enrolled student. As the BCS Foundation states in several places, no gift is required.

The urban lore regarding this annual contribution has been captured by a variety of snap shots over time.

In the 2011, a Bloomberg Magazine article titled “Taxpayers Get Billed for Kids of Millionaires at Charter School” mentioned the following:

Bullis asks families to donate $5,000 per child each year

A foundation set up to help fund the school asks Bullis parents to donate at least $5,000 for each child they enroll. Those who can’t afford to pay should discuss the reason with a foundation member, “recognizing that other school families will need to make up the difference,” the foundation said on its website.

A former Bullis parent commented “They are very aggressive in asking parents for money … If you don’t pay it, word gets out that you aren’t doing your part.” Parents often refer to the payments as “tuition,” she said in an interview.

A member of the Santa Clara County Board of Education mentioned receiving about 20 phone calls from parents who felt pressured to give, because of repeated solicitation in school parking lots, e-mails and phone calls.

A Bullis parent, considered the $5,000 donation requested every year by Bullis to be “money well spent.” He previously sent his child to a private school where tuition was about $25,000 a year.

At that same time, community members recall hearing that BCS had a “Wall of Shame”, which posted the names of those parents who did donate $5,000.

Another snap shot in time was in the 2016 BCS Petition to SCCOE, which mentions the school receives $4,500 per student per year.

The BCS Foundation Boards and families have a long an impressive track record of achieving this goal.

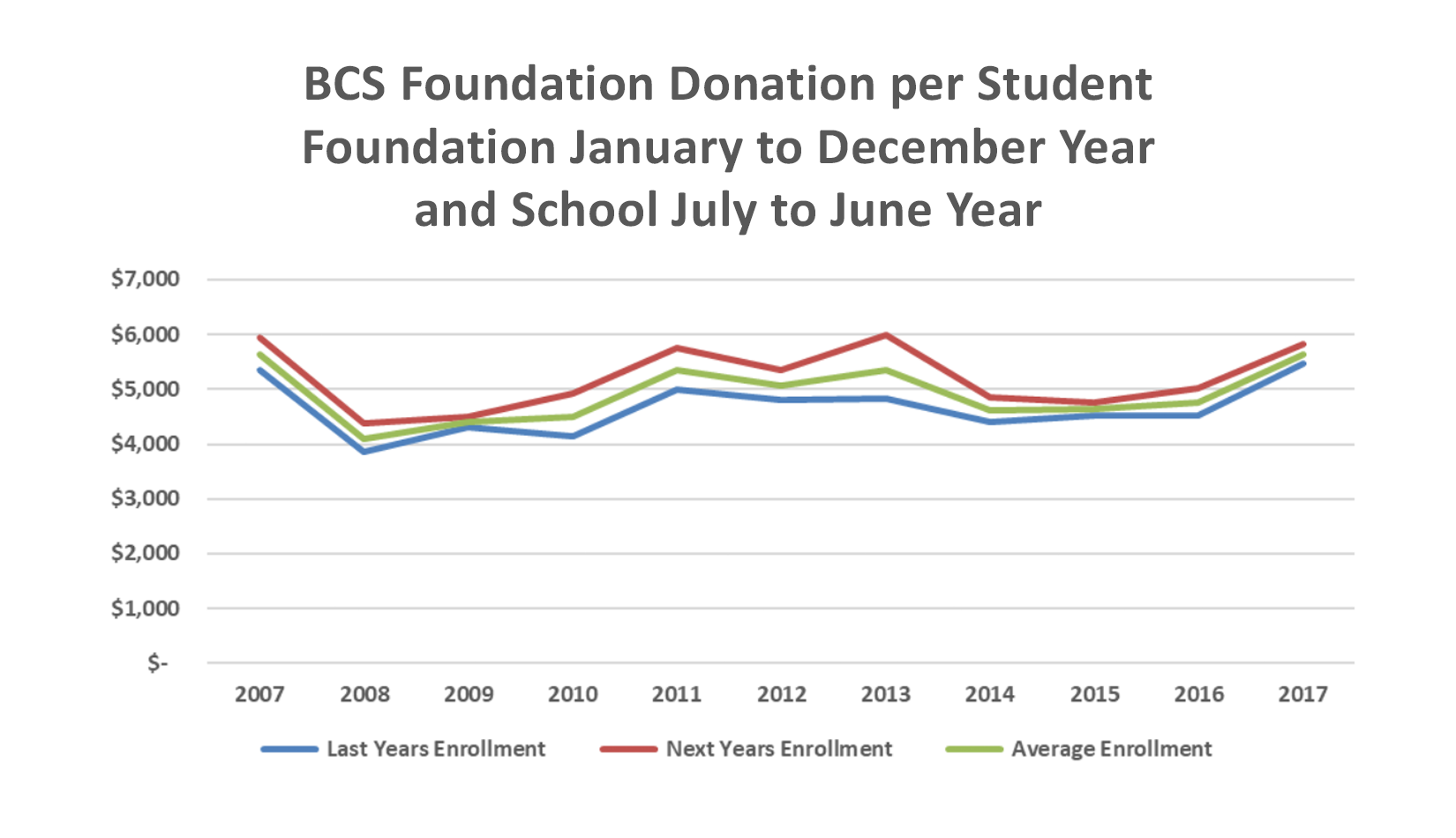

The IRS 990 forms, filed as a requirement of maintaining a non-profit status, indicate aggregate donations to the foundation (calendar year) divided by BCS School enrollment (school year) average in the $4,500 to $5,000 range. From 2007 to 2017, the BCS School Revenue per Student has been approximately $12,000.

The current BCS Foundation web site indicates that: “During the 2019-20 school year, it will cost approximately $14,600 to educate each BCS student.” Historically, BCS School has served their students for approximately $12,000 per student. A $14,600 cost suggests a surprising increase of over 20% from the $12,000 historical run rate.

Approximately 90% of contributions to the BCS Foundation are used to support the BCS School.

The IRS Form 990s indicate that the BCS Foundation chooses to financially support the BCS School using two methods. One is a direct contribution to the BCS School’s non-profit entity.

The other method, although not clearly disclosed, seems to be making direct disbursements to third parties, by the BCS Foundation, for the benefit of the BCS School.

During the early years, 2003 to 2006, many of the formation and start-up expenses were paid directly from the foundation. This seems to have been a practical and reasonable way to get started. BCS School filed its initial IRS Form 990 in 2005, while the BCS foundation began in 2003. Once the school had its own nonprofit entity and had established budgets, expense managements and other operating procedures, the need is not clear as why the foundation continued the practice of making direct disbursements to third parties for the benefit of the BCS School. Comparing disbursements from the foundation, to receipts of the school, indicates this has been an ongoing practice.

During the last decade, 2005 to 2017, direct payments to third parties (not to the school) in support for BCS School have been over $6,000,000. Only $300,000 of these disbursements were disclosed on the foundation’s 20016 and 2017 Form 990’s (over $100K disbursements to independent contractors). The lack of transparency by the BCS Foundation Boards related to the other $5,700,000 of direct payments to third parties raises a number of questions. For example:

Were there errors/mistakes in the preparation of the various IRS forms?

Have there been errors/mistakes in the comparison and interpretation of the BCS Foundation and BCS School IRS Forms?

If the report preparation, comparison and interpretation of the data is reasonable, why were over $5.7M paid directly to third parties?

Were their disbursements for legal fees, bonuses, termination expenses, marketing campaigns, or …….?

The consistently successful fundraising efforts, the low ratio of expenses per contribution dollar, and the carefully considered donation to both BCS School, and directly to third parties, have resulted is a fairly consistent $5.5M to $7M balance in their investment portfolio.

The large investment/fund balance, maintained since 2005, and the very successful and consistent annual fundraising efforts, allow the BCS School to make advance commitments to teachers, staff, aides and counselors delivering art, music, library, computer science, STEM, PE and a variety of services to the students.

Bullis-Purissima Elementary School (BCS School)|

BPES website

This is a non-profit organization founded and chartered in 2003 after Purissima-Bullis, a small (375 students) neighborhood school was closed in the budget squeezes following the dot.com bubble burst. The BCS Charter request was to serve the needs of these Los Altos Hills children. In 2008, LASD budget pressures eased, an $11 million renovation was completed, and the neighborhood school reopened as Gardner Bullis. At that point, the original BCS Charter was no longer relevant. In an effort to reinvent itself, the current version of BCS emerged.

An impressive web site provides an excellent overview of the current version of the BCS mission, goals and the many educational services offered to the students they serve.

The BCS School Board has chosen to not provide readily available public financial transparency. To complement the information on the various BCS web sites, there is also the online material available from the California Department of Education and the Santa Clara Office of Education. Without an adequate level of financial information, the default source of financial information is the BCS IRS 990s. Many aspects of the following discussion are an integration of information from these sources.

As a point of reference, there are 10 years of detailed LASD financial reports available online at ‘https://www.lasdschools.org/District/9821-Annual-Budget.html. The length of each of these documents range from 138 pages to 174 pages.

Historically, BCS school has served their students for approximately $12,000 per student. The BCS School revenue reflects a similar stability, approximately $12,000 per student per year.

The balance sheet is straightforward. Cash is the lifeblood of all organizations. BCS School operates on a fiscal year of from July 1st to June 30th. The graph below suggests a typical June 30 cash goal is approximately $400,000. The exact figure is not as important as the sound financial management suggested by having a financial goal setting and disciple.

Managing a large cash balance (e.g. 2006) may have been a distraction from the day-to-day challenges of serving students. One way to simplify cash management might be to recognize, in revenue, a contribution from the BCS Foundation, then create an account receivable, and then draw the funds as needed. This may be particularly helpful since the foundation has a January 1st to December 31st calendar year. The foundation can manage its year-end financial statement while providing cash management services to the school.

The fixed assets of BCS are small and reflect modest purchases of equipment, and the impact of LASD absorbing the cost of providing the facilities. In 2004, to get the school started, the BCS Foundation probably funded (~$677,000) for portable foundations.

Sometimes the footnotes, disclosures and inconsistencies are as interesting as the financial statements. For example, the reporting legal fees, the compensation of the highest paid employees or inconsistently aggregating together different categories of expenses.

The California Charter Act exempts charter from many aspects of the education code, including many of the labor practices. For example, the BCS School Board is free to compensate employees without reference to union agreements. The IRS does require disclosure of the compensation of the highest paid employees. Over the years the highest paid employee has received compensation comparable to or greater than the compensation of the highest paid employee at each of the surrounding school districts.

Inconsistencies in reporting are curious, since the prior period report is immediately available as a reference. When year-to-year reporting does change, it causes a reader to question, was there a change in the IRS reporting format (there was one in 2014), or was there a clerical error (understandable), or was there an effort to avoid transparency? For example,

For 6 years, a $200,000 expense category tiled “Professional Consulting Services” was reported as a line item;

For 2 years, a new category titled “Field Trips”, with a similar dollar value, was a separate line item;

For 1 year, “Field Trips” was aggregated with the even larger dollar value “Instructional Materials - Books & Supplies” category and reported as “Other Expenses”;

For 1 year, the two more descriptive line items were returned;

For the last 5 years, the bulk of the money for field trips moved to the recently formed non-profit, Bullis Booster Club

For the first 2 years, the expense was reported in two different, totally non-descript business codes.

Bullis Booster Club

Bullis Booster Club website

Bullis Booster Club is non-profit organization that serves a “Bullis charter school’s parent led volunteer organization. Our mission is to unify the school community around the BCS mission and support our school, its students and staff in various ways.” More information is available on the many services the Club provides to BCS students. It was incorporated as an non-profit entity in 2013 and has raised between $50,00 and $100,000 each of the last five years pursuing their mission.

The organization has also become the BCS vehicle to collect and disburse funds in support of the optional "Non-Program Field Trips” which are not part of the school's curriculum and do not count toward course credit. Attendance is voluntary, recreational and not an educational activity.

Over the last four years, funds collected each year, have been between $250,000 and $430,000 for what is reported as Business Code 561990 or 900099, which is a non-descriptive definition referred to as “Other Activity”.